Wealthfront retirement calculator

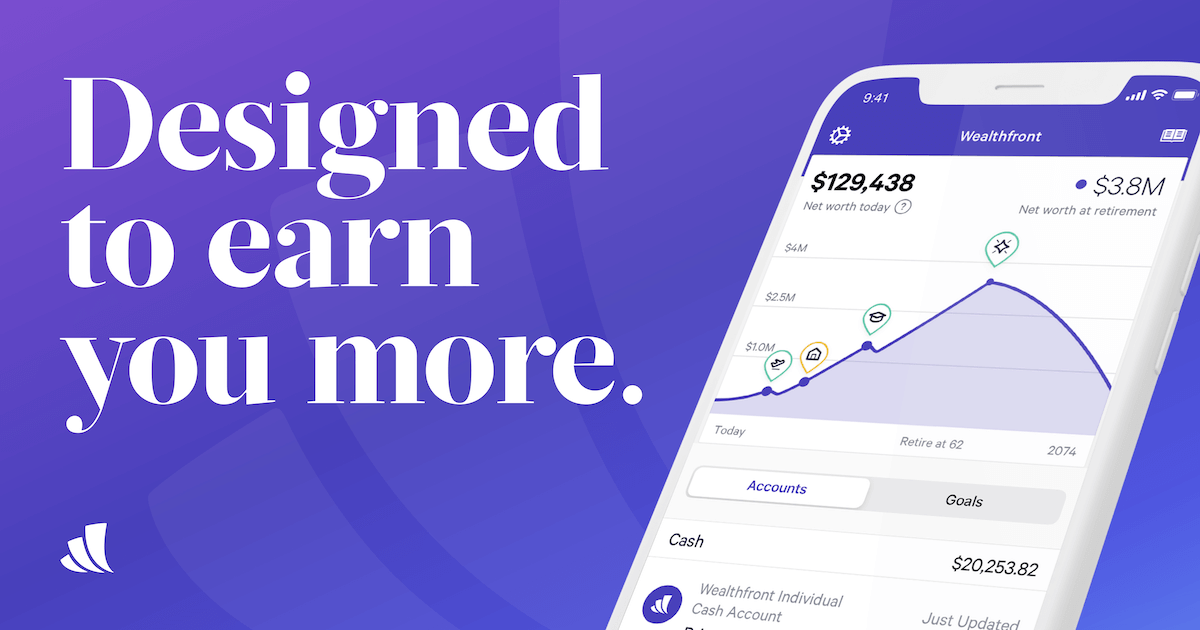

A Retirement Calculator To Help You Plan For The Future. Our advice engine Path.

Betterment Vs Wealthfront Vs Acorns Which Robo Advisor Wins In 2022 Robo Advisors Investment Tips Real Estate Investing Books

Social security is calculated on a sliding.

. Select the prompt to set up your automated savings plan. Our retirement smart savings calculator will help you understand how much youll have and how much youll need. The FIRE retirement calculator can help you determine how much money you need to retire earlier than you ever thought.

Banking And Investing In One Place. Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. It costs 025 percent annually or 25 for every 10000 invested and Wealthfront may put up to 20 percent of larger portfolios in the fund.

Well save into each account until the target is reached then start saving in the. Financial planning tools. Use this retirement calculator to create your retirement plan.

Automated Investing With Tax-Smart Withdrawals. Wealthfronts free Path tool for mobile and desktop helps people plan for buying a house retirement college and general savings goals and you. Some things you pay for.

Interface of a retirement calculator on Nerdwallet. Ad Simplify Your Finances. It gives me a calculation if I am saving enough and give an idea of how much I.

Wealthfronts financial planning experience helps estimate your net worth at retirement and what you could spend per month at that time. Grow Your Long-Term Wealth. Getting an early start on retirement savings can make a big difference in the long run.

Ready To Turn Your Savings Into Income. Our advisory fee is simple just 025 annually. Wealthfront estimates that it raises the average.

View your retirement savings balance and calculate your withdrawals for each year. The best things pay for themselves. Ad This guide may help you avoid regret from certain financial decisions with 500000.

Wealthfront Strategies receives an annual. Best Brokers for Low Fees. However with our financial planning app all you do is electronically link your accounts banking mortgage investments.

Banking And Investing In One Place. Wealthfront too provides a retirement. People who have a good estimate of how much they will require a year in retirement can divide this number by 4 to determine the nest egg required to enable their lifestyle.

Save Spend Invest Plan. As soon as you finish the questionnaire Wealthfront will calculate two personalized investing plans based on your answers - one plan for a taxable account and one for a retirement. Best Ways to Invest 30K.

Save Spend Invest Plan. Grow Your Long-Term Wealth. AutomaticallyAll In One Place.

The Wealthfront Risk Parity Fund is managed by Wealthfront Strategies LLC Wealthfront Strategies an SEC registered investment adviser. Best Online Brokers for Stocks. Investopedia designed a system that rates robo-advisors based on nine key categories and 49 variables.

I am using Wealthfront which complies all my retirement accounts. In connection with obtaining this ranking. For instance if a.

Youll also learn at what age youll be able to retire. If you have a 500000 portfolio download 13 Retirement Investment Blunders to Avoid. By saving an extra 76 per month the 25-year-old in the example above can close the 265261 shortfall.

Ad A Rule of Thumb Is That Youll Need 10 Times Your Income at Retirement. Wealthface is an easy way to invest trade save and build your portfolio with. It also offers 401k plans for companies and all employers who wish to help their employees prepare for retirement.

AutomaticallyAll In One Place. Not only do you get the luxury of effortless investing but thanks to our tax. Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account.

Set targets for your account s. Ad Simplify Your Finances.

Wealthfront Review Pros Cons And Who Should Set Up An Account

Wealthfront Planning Investing Made Easy

At Wealthfront We Believe That Everyone Deserves Access To Sophisticated Financial Advice Without The Hassle Or Investing Saving For College Financial Advice

How Does Wealthfront Make Money Fourweekmba

Wealthfront Review A Leading Digital Wealth Advisor For Your Money Robo Advisors Investing For Retirement Advisor

/Wealthfront_Recirc-929ccd1129324cdc9153bc1225c721de.jpg)

Wealthfront Review 2022

Wealthfront Investment Methodology White Paper Wealthfront Whitepapers

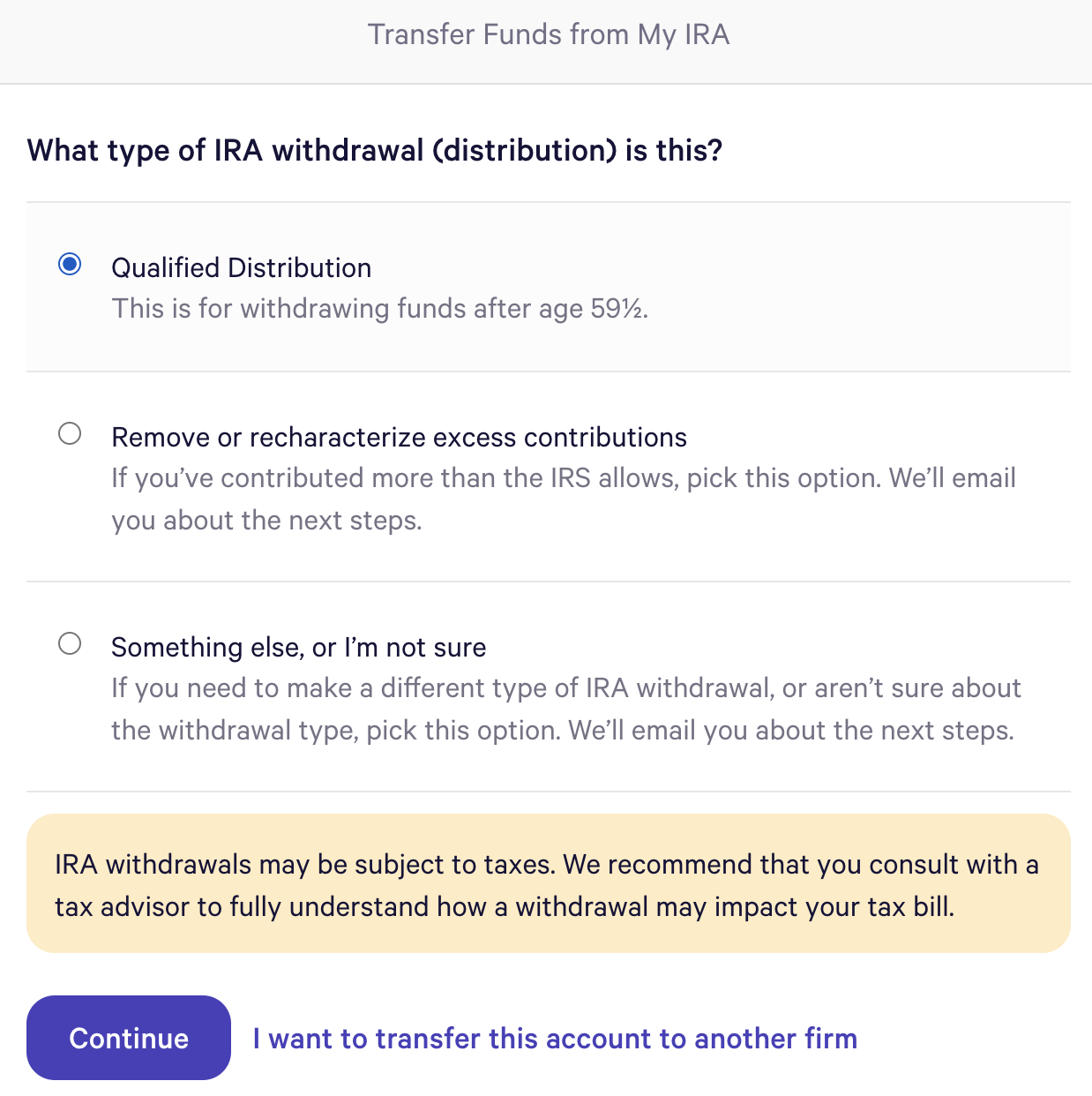

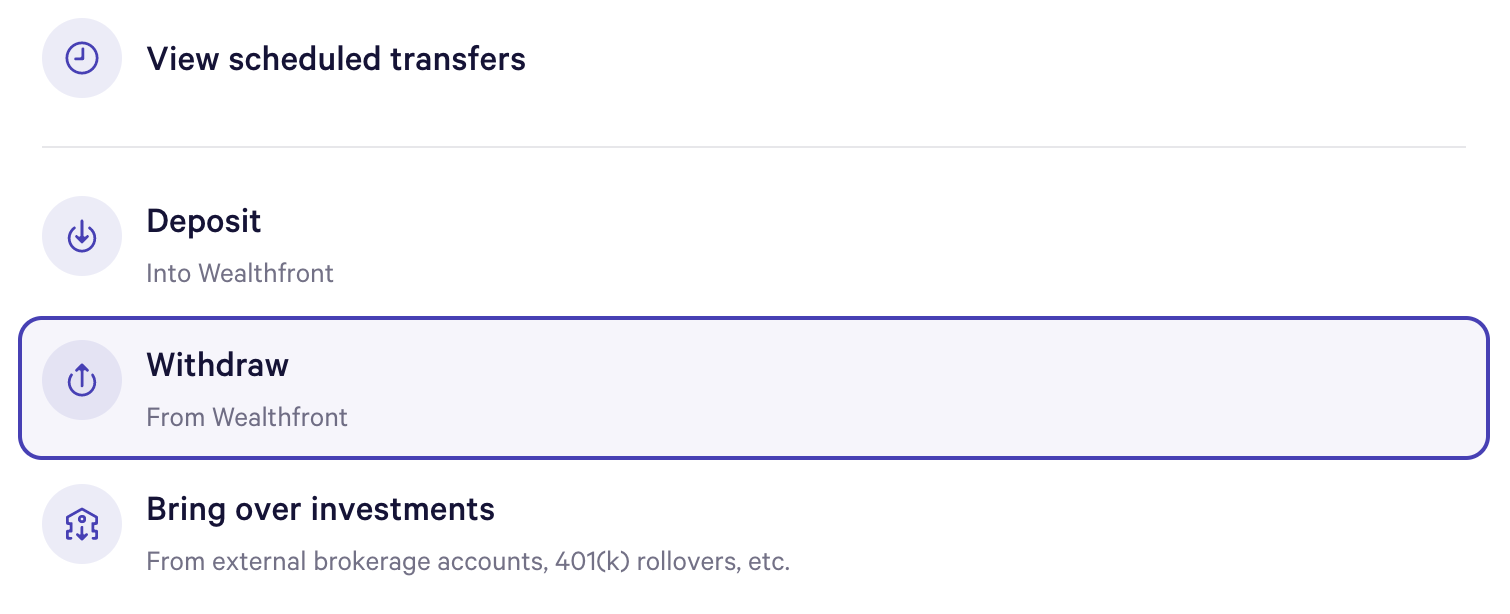

How Do I Take My Rmd From My Retirement Account Wealthfront Support

Pin On Money Smarts

Wealthfront Investment Methodology White Paper Wealthfront Whitepapers

Wealthfront Review Smartasset Com

How Do I Take My Rmd From My Retirement Account Wealthfront Support

Is Investing With Wealthfront A Smart Move For My Financial Future

/wealthfront-vs-etrade-core-portfolios-3cf44d7f34e846d6993d425e0d9f3888.jpg)

Wealthfront Vs E Trade Core Portfolios Which Should You Choose

Wealthfront Review Smartasset Com

Announcing Wealthfront For Iphone Store Layout Graphing Calculator Iphone

Wealthfront Cash Account Adds Checking Features